"A longer life means you save more"

The "healthy ageing" or "healthy longevity" trend is affecting more and more industries and promises a lot of growth. But not all companies benefit in the same way. Investors should be careful not to fall for dubious promises. Iwan Deplazes explains which sectors are likely to be among the winners and how to invest in this trend.

Interview with Iwan Deplazes

Martin Spieler: The desire for a healthy and long life - also known as healthy longevity - is a megatrend, especially in the USA. What influence does it have on the economy?

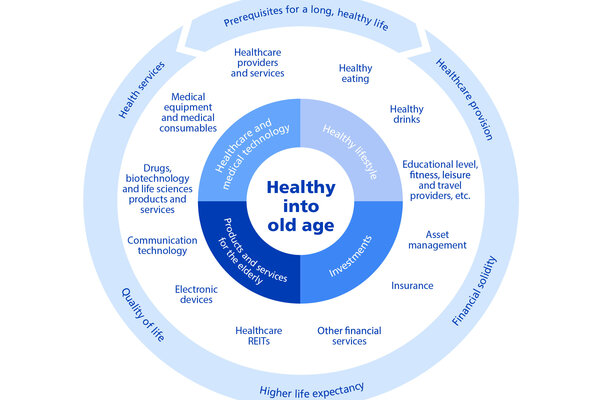

Iwan Deplazes: The influence is increasing, simply because the desire for a long and healthy life is becoming ever stronger. The foundations for this are laid at a young age by paying attention to one's diet or exercising regularly. This trend therefore encompasses a broad spectrum of industries. The economic effect is correspondingly large.

As people get older, their needs also change. Which sectors benefit most from this?

Above all, the healthcare and pharmaceutical sector in general and preventive medicine in particular. Manufacturers of medical devices that record vital functions are also likely to benefit. There are also companies from the food industry that specialise in the production of healthy food. The financial industry is also part of Healthy Longevity: living longer means saving more, and saving better.

Switzerland is one of the most important pharmaceutical and biotech centres in the world, with large corporations as well as unlisted companies. Are you all among the winners?

No, definitely not. The Healthy Longevity growth trend has triggered a kind of gold-rush mood worldwide. As a result, many exciting developments are emerging. However, only a fraction of them will actually succeed.

Growth trends create opportunities for investors. At the same time, the risk of falling for charlatans is also increasing.

That is certainly the case. A growth trend always attracts different players. Among them are those with noble intentions, but also dubious providers. That's why business ideas and models need to be rigorously analysed in terms of their uniqueness and market viability. The financial health of the companies must also be scrutinised.

How can private investors invest in reputable companies?

One option is to take a close look at the companies yourself and try to distinguish the "good" from the "bad". Or you can invest in a collective vehicle, an investment fund, where professional teams take over the selection. We ourselves recently launched a themed fund on the growth trend of healthy longevity.

Thematic funds offer good diversification. To what extent is there a risk that investors will nevertheless be exposed to strong price fluctuations?

This risk exists. However, the fluctuations can be even greater if you invest in individual stocks. This is because some business models can become obsolete very quickly. In our view, longevity is not a temporary hype, but will be with us for a longer period of time. Fluctuations will also be part of this trend, but probably not as pronounced as with other trends.

This interview was first broadcast in a slightly modified form in the "Geld" programme on Tele 1, Tele M1 and TVO on 20 September 2024. (Video available in Swiss German only).