CHF corporate bonds: Indexed and sustainable investment

In an environment of continued low yields and a possible, albeit moderate, rise in interest rates, we believe it is worthwhile to take a closer look at CHF corporate bonds. We consider their tactical inclusion as part of the strategic CHF bond ratio an interesting addition to the portfolio. We are now offering a corresponding index product, including consideration of sustainability aspects and climate targets.

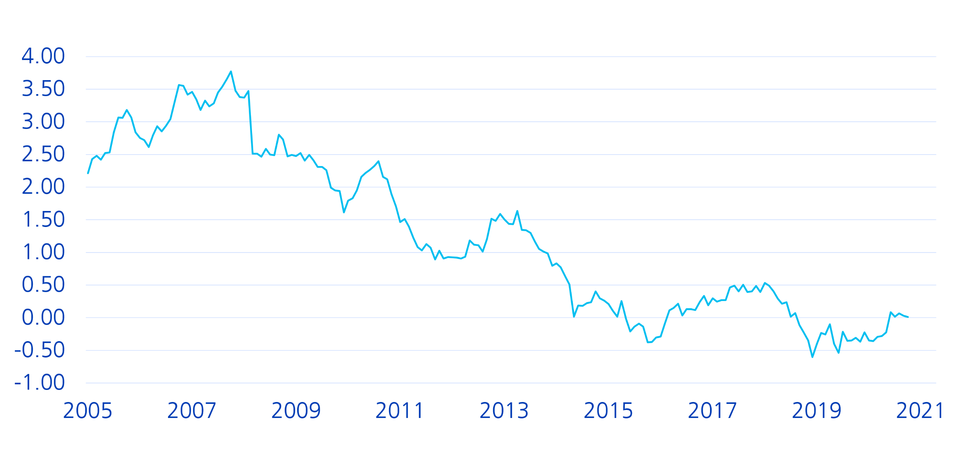

Falling interest rates have been the main driver of performance in CHF bonds in recent years. For several years now, investors have been confronted with negative yields on CHF bonds (see chart). Despite this environment, this asset class had been achieving attractive, risk-adjusted returns up until 2019. From our point of view, the prospects of additional returns are limited due to further declines in yields with longer maturities. In fact, a rise in interest rates seems more likely. This increases the interest rate risk.

Declining yields into negative territory: CHF 10 YR swap

A more detailed analysis of the expected development of CHF corporate bonds can be obtained by considering the risk premium, which consists of three components:

- Credit risk premium (default risk)

- Liquidity risk premium

- Market risk premium (including interest rate risk)

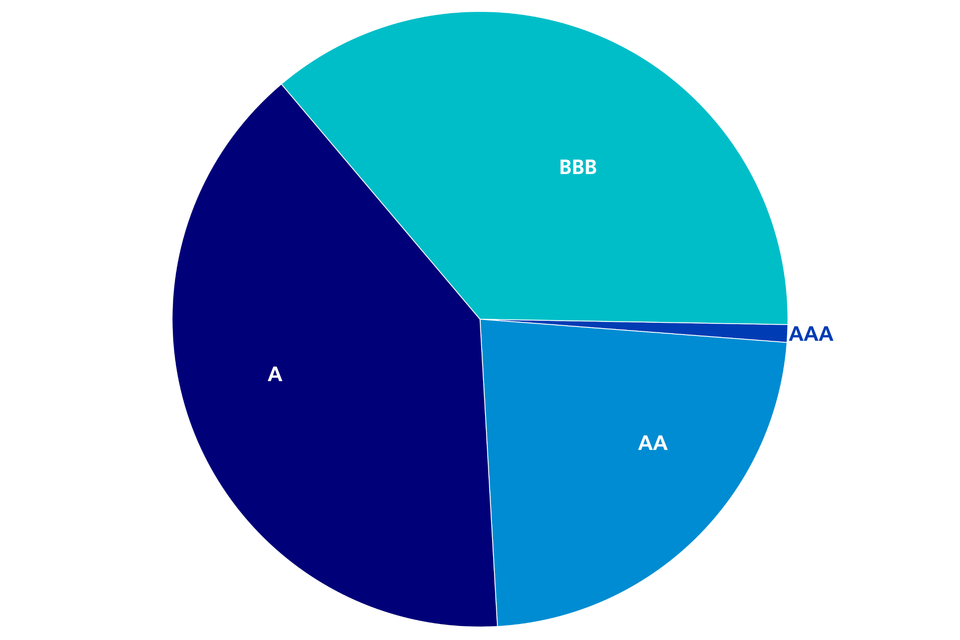

As part of the massive monetary and fiscal support measures, liquidity and credit risk premiums have fallen sharply and should remain relatively stable in our view. Careful management of balance sheets in the current economic environment is likely to keep default rates of Swiss and international CHF issuers at a low level. In addition, all bonds in the Swiss Bond Index® Corporates are investment grade (see chart).

Rating distribution of the SBI® Corporates for CHF corporate bonds

The market risk premium could increase as a result of any increase in volatility. The shorter duration of CHF corporate bonds compared to CHF government bonds offers some protection against this increase. The slightly higher yields on average compared to CHF government bonds also maintain interest in CHF corporate bonds. The main risks that need to be monitored could come from surprises in economic data and the resulting changes in monetary policy scenarios. If yields rise across all maturities, CHF corporate bonds will not be able to escape this influence.

Consideration of sustainability aspects

Greater consideration of sustainability aspects in the valuation of companies results in exciting potential for companies that meet the corresponding criteria. The quality of the data collected in this process plays a central role here. In our opinion, companies with a good ESG rating show potential for further spread narrowing as well as a lower risk in relation to the sustainability of their business model and possible scandals than companies with lower values.

Long-standing expertise

We draw on many years of expertise to integrate sustainability aspects into the investment process and portfolio construction. The various sustainability risks are material in all asset classes – including CHF corporate bonds. The elements of our sustainable investment process, such as the consideration of ESG criteria, supplement the fundamental financial analysis and enable early recognition of risks and opportunities and thus better (risk-adjusted) performance.

New: Sustainable index product for CHF corporate bonds

We are now offering an index-linked sustainable product for CHF corporate bonds. The instrument tracks the Swiss Bond Index® Corporates benchmark and demonstrates a low tracking error and broad diversification despite the integration of sustainability aspects. These properties combined with cost-effective implementation enable optimum replication of the Swiss Bond Index® Corporates (see chart).

SBI Bond Index® Corporates, ISIN CH0119565890