Swiss Real Estate Funds: Cut Down to Eight

Swiss real estate funds are increasingly in the spotlight due to the announced mergers of real estate funds of the major banks UBS and Credit Suisse. What this development means for active investors.

Authors: Flurin Joller and Elias Lipp, Senior Product Specialist Equities & Themes

On 7 November 2024, UBS Fund Management (Switzerland) announced how it will structure its real estate fund offering following the integration of Credit Suisse Funds AG. Various mergers were announced. As a result of the takeover of Credit Suisse, such a step was to be expected. Of the 13 real estate funds that are part of the SXI Real Estate® Funds Broad Index (SWIIT Index), eight are expected to remain by 2027. The following mergers have been announced:

- 2025: Four Swiss residential real estate funds with direct ownership (CS REF LivingPlus, UBS Direct Residential, Residentia and CS REF Hospitality)

- 2025/26: Two mixed-use Swiss real estate funds with direct ownership (CS REF Green Property and UBS Direct Urban)

- 2026/27: Two commercial Swiss real estate funds with indirect ownership (UBS "Swissreal" and CS REF Interswiss)

UBS will thus take the opportunity to create larger real estate funds that will have a higher weighting within the SWIIT Index. As of 8 November 2024 (the day following the announcement), the three funds would have market capitalisations of CHF 5 billion (1), CHF 2,94 billion (2) and CHF 3,36 billion (3). In terms of their index weighting, these three merged funds would therefore rank on positions 2, 4 and 6 within the SWIIT. The share of all UBS real estate funds in the market capitalisation of the SWIIT Index would be around 49%. UBS has also announced that it will charge a standardised management fee of 0,54% on the funds , which should not change the overall fee structure too much. In principle, the real estate funds of the former Credit Suisse will therefore tend to be slightly more expensive and those of UBS slightly cheaper.

Merging real estate funds is complex

When merging Swiss real estate funds, there are a few points to bear in mind. Below are some important steps:

- Approval of mergers by the Swiss Financial Market Supervisory Authority (FINMA)

- Information for investors

- Negotiations with various cantonal tax authorities, including property gains and transfer taxes

- Complete financial statements of the individual real estate funds for the purpose of determining the quotas on the merger date

Different reactions

On 8 November 2024, one day after the announcement of the merger, there were stronger price reactions at the real estate funds concerned. For example, the fund Residentia went out of trading with a plus of 26,8%. The three other funds to be merged with Residentia reacted differently: while the two funds CS REF LivingPlus (-4,6%) and UBS Direct Residential (-5,1%) came under pressure, the CS REF Hospitality rose by 10,8%.

The role of the (dis)agios

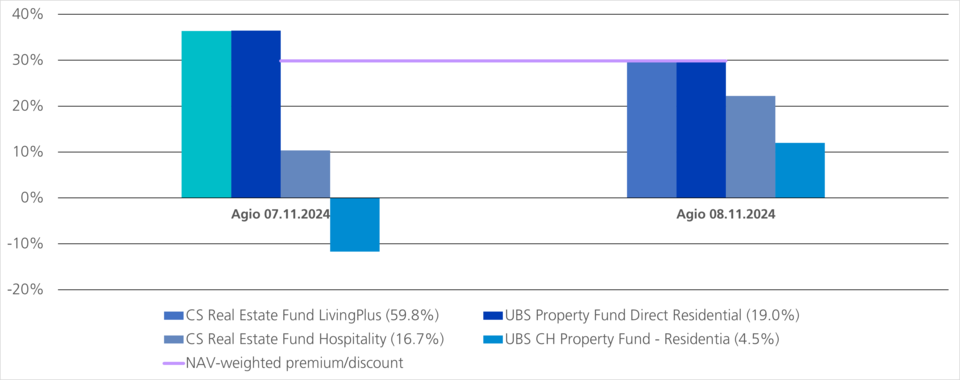

How can the different price reactions of the four funds be explained? The reason is that the listed real estate funds trade on the market at a premium (agio) or a discount (disagio) to their net asset value (NAV). In the example of the funds listed, they traded at completely different premiums on the day of the announcement. Market participants quickly priced in the announced mergers and the premiums converged to the calculated NAV of the future fund on the next trading day. In this calculation, the fund with the highest fund volume also has the greatest impact on the estimated NAV after the merger.

Development of the premiums of the four Swiss residential real estate funds with direct real estate holdings before and after the announcement

Active investors, who correctly anticipated the mergers, have already been able to benefit from the strong price movements. It will also be worth keeping an eye on the actual fundamental data in the future. Until the planned mergers are completed, there are still various uncertainties that could lead to changes in the NAV ratio (e.g. revaluations of the properties in the financial statements, distributions, possible tax implications). Particularly in this asset class with limited liquidity, it is important to position yourself properly. Active investors can thus exploit any inefficiencies in the market.

Fewer funds - less return potential?

The question also arises as to whether active investors are restricted in generating potential excess returns due to the smaller universe in the SWIIT Index following the mergers. This is because a larger number of investment opportunities is generally advantageous, as it offers more positioning options. However, with 38 funds in the SWIIT Index, the universe remains sufficiently large. We also expect further listings in the near future, which would increase the number of real estate funds in the SWIIT Index again.