"If interest rates fall, bond prices rise"

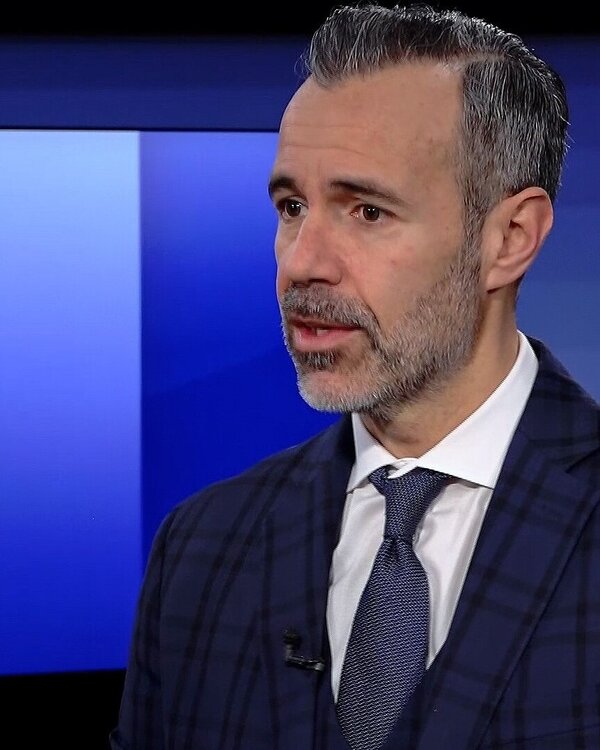

Bonds are yielding returns again - this also applies to Swiss government bonds. René Nicolodi, Head of Equities and Thematic Investments, explains in an interview what investors should look out for when buying bonds.

Martin Spieler: Bonds are experiencing a renaissance. Nevertheless, the yield on very safe securities - such as Swiss bonds - is still below inflation.

René Nicolodi: That is the case. The average yield on Swiss Confederation bonds with a term of ten years is currently below 1 per cent. By comparison, the inflation rate in Switzerland was 1.3 per cent in January 2024. Investors who invest their money exclusively in Swiss Confederation bonds cannot currently compensate for the rise in prices through the yield.

Corporate bonds offer higher returns. What is the risk/return ratio in this segment?

The yield on the Swiss Bond Index for corporate bonds was a good 5.5 per cent in 2023, following a weaker previous year. The expected yield is currently between 1.5 and 2 per cent. The minimum rating in the Swiss Bond Index for corporate bonds is BBB-. The average rating is A-.

Bonds are more stable in price than equities, but they react immediately to interest rate risks. What do you need to bear in mind?

The following applies to bond investments: if interest rates rise, this leads to price losses for existing bonds because newly issued bonds pay higher interest. This also means that if interest rates fall, bond prices rise. Bonds with longer maturities are more affected by interest rate changes because it takes longer for the capital to be repaid.

How attractive are bonds in dollars and euros at the moment?

At first glance, USD or euro government bonds are very attractive compared to Swiss government bonds. US government bonds yield a good 4 per cent, government bonds in euros between 2.5 and 4 per cent, depending on the country. However, investing in foreign currencies exposes investors to foreign currency risks.

So the risk that currency losses will eat away the entire return is real?

This can and does happen. For example, the Euro has lost around 4 per cent against the Swiss franc within a year, compared to 6 per cent for the US dollar. Investors can hedge against currency risks, but this comes at a cost. In practice, the entire currency risk in a portfolio should not be hedged, as currencies can act as a source of diversification and a source of returns.

What is your recipe for bond investors?

For private investors, it is easiest to invest in a bond fund that takes into account various borrowers and maturities - in other words, that invests in a broadly diversified manner. At the same time, it is important to take a look at the net fund returns when choosing a fund. And, as always, it is advisable to talk to your customer advisor before making a specific investment.

This interview was first broadcast on "Sendung Geld" (in Swiss German) on 15 March 2023 on Tele 1, Tele M1 and TVO.