How to avoid investment mistakes in the stock market year 2025?

Insufficient diversification, trying to time the market, and holding onto losses for too long: These classic mistakes threaten investors again in 2025. René Nicolodi, Head of Equity & Themes in Asset Management at Zürcher Kantonalbank, offers solutions in the interview.

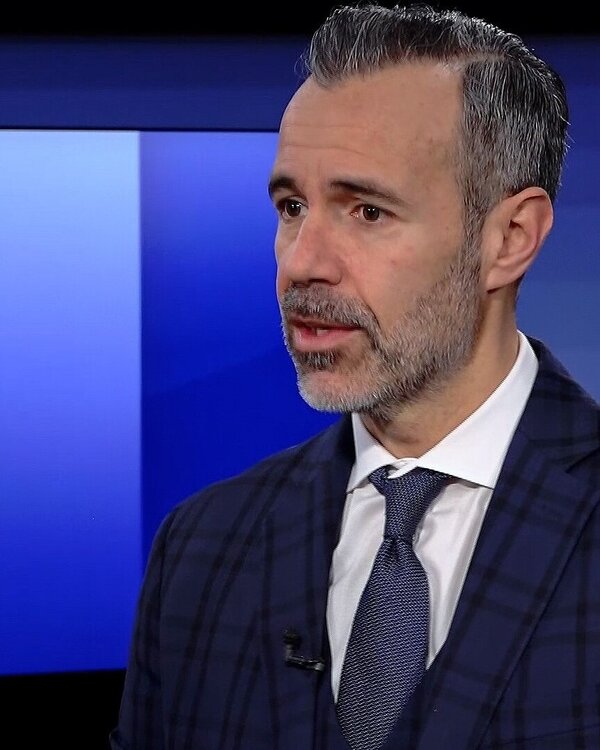

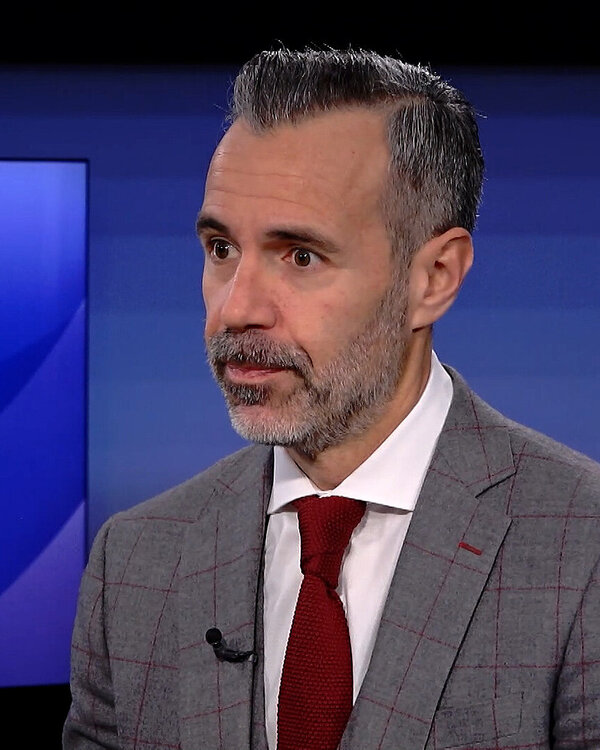

Interview with Dr René Nicolodi

The biggest mistake is not investing at all.

Dr René Nicolodi, Head of Equity & Themes in Asset Management at Zürcher Kantonalbank

Martin Spieler: A common investment mistake is inadequate diversification of investments. How can this be avoided?

René Nicolodi: Today, private investors can invest even small amounts in funds. Instruments include, for example, fund savings plans or portfolio funds. These make up only one position in the portfolio but allow for a broadly diversified investment that covers multiple market regions and asset classes.

Another classic mistake is that investors invest randomly. How can a solid investment strategy be set up that also allows for the tracking of long-term trends?

The biggest mistake of all is not investing at all. Those who invest should do so regularly: preferably quarterly or monthly. This allows for good average prices to be achieved and avoids the ups and downs of the stock markets. Emotional timing generally does not generate profit.

Many want to get more return from their savings but want to take as little risk as possible and therefore avoid stocks that are subject to price fluctuations. Can this work?

Return without risk is an illusion; there is no so-called free lunch. It is all the more important to know one's own risk capacity and risk tolerance. This helps to manage turbulent market phases with a certain calm.

Many investors often behave emotionally in the stock market. This leads to irrational behaviour – how can this be prevented?

Time in the market is more important than timing the market, as we say. This means: a well-formulated investment strategy is very important for long-term investment success. Short-term decisions motivated by greed or fear usually do not prove to be a good solution.

It is often advised to stick rigidly to the investment strategy. But doesn't this carry the risk of holding onto losing positions?

In principle, it is worthwhile to stick to an investment strategy. At the same time, there is a tendency to hold onto book losses for too long. This is also psychologically based – realising losses hurts us more than the joy of making gains. Therefore, it is important to correct this behaviour. So, look to the future rather than being guided by the past. Secondly, formulate clear rules from the start about when you want to sell.

What strategies are recommended to invest better in 2025 – and how can long-term oriented private investors avoid the mentioned mistakes?

Firstly, it is advisable to invest broadly diversified and according to one's own risk behaviour and risk capacity. Secondly, it is important to invest regularly – and thirdly, the investment strategy should be reviewed and adjusted regularly. Here, a conversation with a customer advisor can be useful.

This interview was first broadcast in a slightly modified form in the programme "Geld" (in German only) on 10 January 2025 on Tele 1, Tele M1, and TVO.