Decarbonisation thanks to powerful drivers

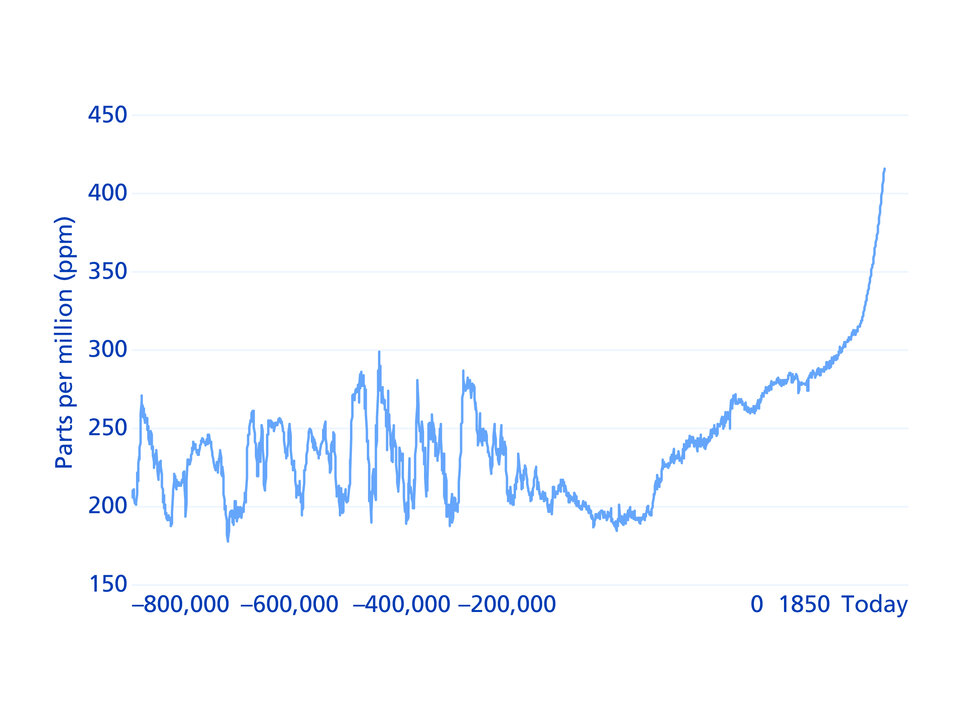

Cutting CO2 emissions, i.e. decarbonisation, affects almost all economic sectors and most United Nations Sustainable Development Goals (SDGs), which include, for example, affordable and clean energy (SDG 7) and life on land (SDG 15), which aims to restore endangered ecosystems. Decarbonisation can count on some powerful drivers. The European Union's Green Deal, for example, is pursuing the ambitious goal of making Europe the first climate-neutral continent by 2050. Added to this is the technological progress and entrepreneurial awareness of climate change.

Mobilising trillions

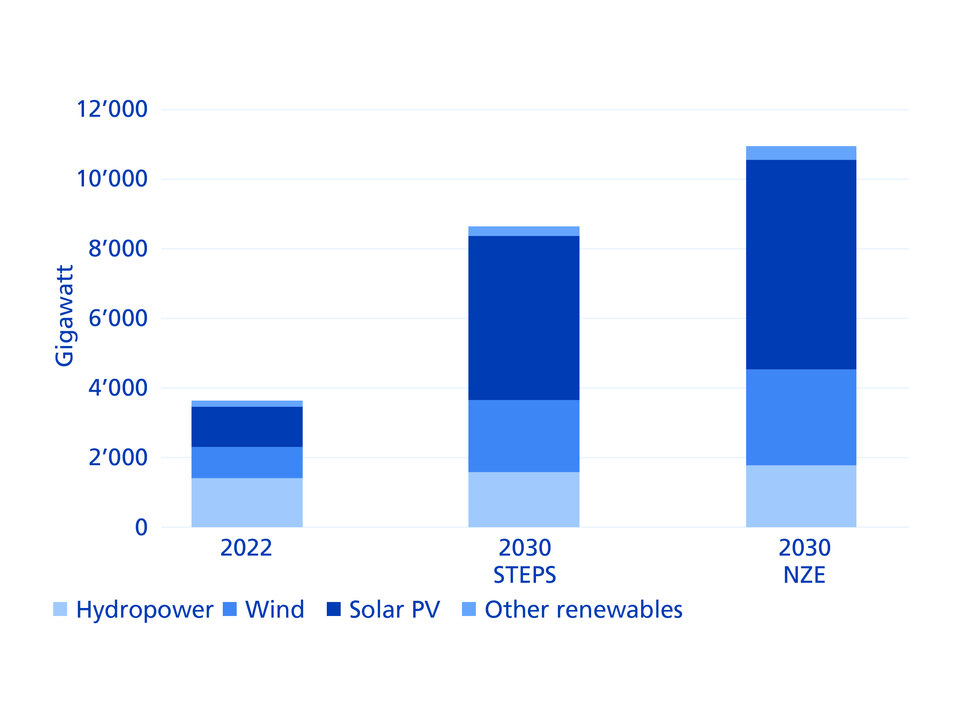

This creates corresponding economic potential. For example, the International Energy Agency estimates that from 2030, depending on the scenario, decarbonisation could result in annual investments of between USD 2.3 trillion and USD 4.5 trillion. The effective solutions for coping with climate change are numerous and the technology has in many cases already been established. In the analysis they are divided into four fields: renewable energies such as solar and wind power (see chart below), as well as the energy efficiency achieved with heat pumps, for example. In addition, there is the transition to sustainable mobility, which can be achieved with electric vehicles and public transport, for example. Finally, the area of resource efficiency is important, such as with the transition to a circular economy. These four fields correspond to the main investment areas we have identified for investors.