Shortage of raw materials threatens energy transition

Copper and other minerals such as nickel, lithium and cobalt are essential for the electrification of the global economy. However, current capacities are not able to meet future demand. China also poses a peril to the energy transition.

Autoren: Dominik Ladner, Dr. Dr Gerhard Wagner

.r200img.2000x1000.jpg/1700148935717/istock-695604842-%281%29.jpeg)

Copper is a key raw material in the energy transition. Its excellent conductivity makes it indispensable for numerous electrical systems. According to the International Energy Agency (IEA), one electric vehicle alone contains around 53 kilograms of copper. Ten million electric vehicles were already sold worldwide in 2022, an increase of 60% compared to the previous year. However, the rising demand contrasts with a precarious supply situation: while the majority of countries are aiming for the net-zero target, the crucial role of copper in achieving this goal is becoming increasingly clear. An average of renowned expert forecasts shows a sharp increase in copper demand to over 32,550 kilotonnes (kt), or 32.5 million tonnes of copper, by 2030. This would equate to a deficit of 3,320 kilotonnes for the year 2030 (see Figure 1).

Reasons for the "copper squeeze"

- Mining companies are struggling to meet demand as too little has been invested in exploration and production in the past.

- The industry is suffering from falling ore grades (approx. 1%). This increases extraction costs.

- If promising deposits are discovered, they are often located in politically unstable regions.

- Projects take an average of ten to 15 years from discovery to first production.

This gap between demand and supply, as illustrated in Figure 1, highlights the urgent need to promote mining investment strategies and accelerate project approval processes.

Innovation, increasing capacity and recycling

While some companies are nevertheless able to develop new resources, such as Ivanhoe Mines' Kamoa-Kakula mine (DRC) (5-6% ore grades with high growth), such projects remain rare. In response, the industry is increasingly focussing on innovative solutions and the expansion of existing mining operations. Companies such as Rio Tinto are exploring technologies such as leaching to extract copper from previously overlooked low-grade sulphide-bearing deposits. Automation and electrification initiatives (e.g. Swedish mining company Boliden) are revolutionising operations, reducing labour costs, improving safety and helping to reduce the carbon intensity of a portfolio. In addition, recycling is becoming increasingly important. Over the past five years, around 30% of copper demand has been met through recycling. This circular approach, particularly in relation to the recyclability of end products such as electric vehicle batteries and solar panels, reduces the pressure on primary resources.

Nevertheless, the impending copper shortage poses a critical challenge for the transition to clean energy. It is crucial to find a balance between immediate supply needs, long-term investments, technological innovation and recycling efforts. Collaborative efforts from decision makers, industry leaders and investors are therefore important to effectively address this issue. Copper's central role in the energy transition thus emphasises the need for strategic planning and global collaboration to ensure a sustainable and uninterrupted transition to a greener future.

Huge growth rates for lithium, cobalt and nickel

In addition to copper, the timely achievement of the energy transition requires other raw materials, namely lithium, cobalt and nickel. The demand for these minerals has increased dramatically in just five years and will continue to rise sharply until 2050.

Driven by rising demand and high prices, the market size of these critical minerals has doubled over the past five years, reaching a value of USD 320 billion in 2022. This is roughly equivalent to the value of iron ore produced globally in 2022. As a result, these minerals are now taking centre stage in the mining and metals industry. This is bringing new revenue streams to the industry, creating jobs and, in some cases, helping to diversify coal-dependent economies.

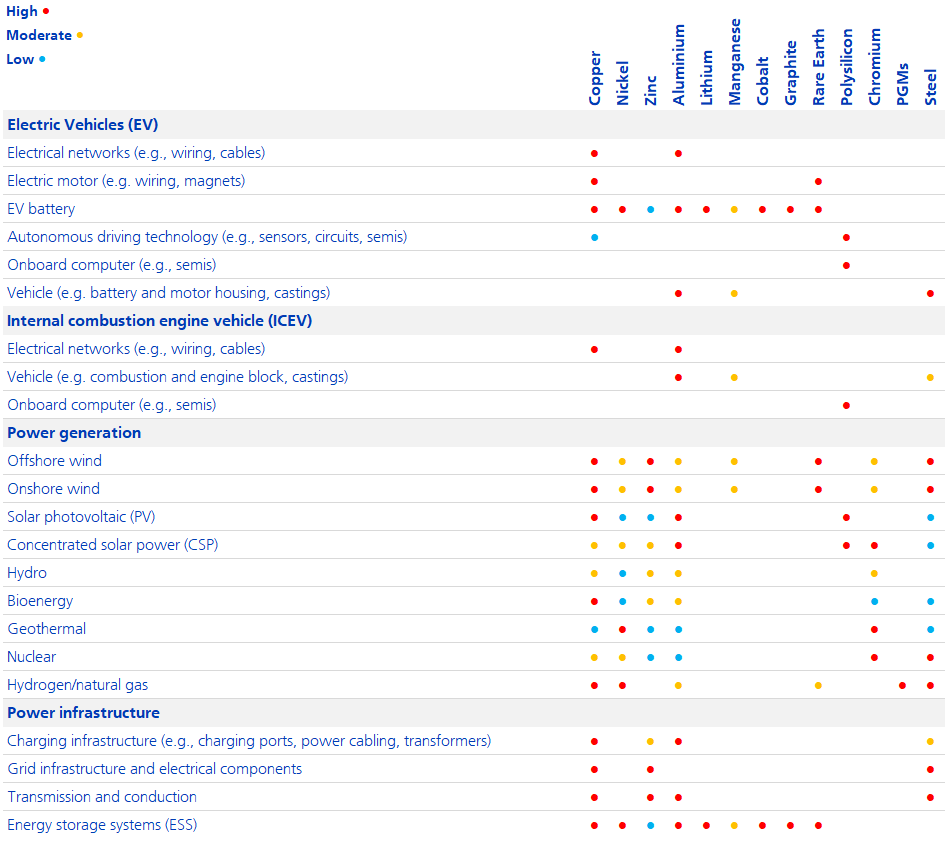

Where are these metals used?

The use of materials is multi-faceted and will be increasingly driven by energy technologies in the future (see Figure 3). For example, nickel, together with copper and aluminium, is widely used in electric vehicles, power generation and energy infrastructure. Lithium and cobalt, on the other hand, are primarily used in batteries.

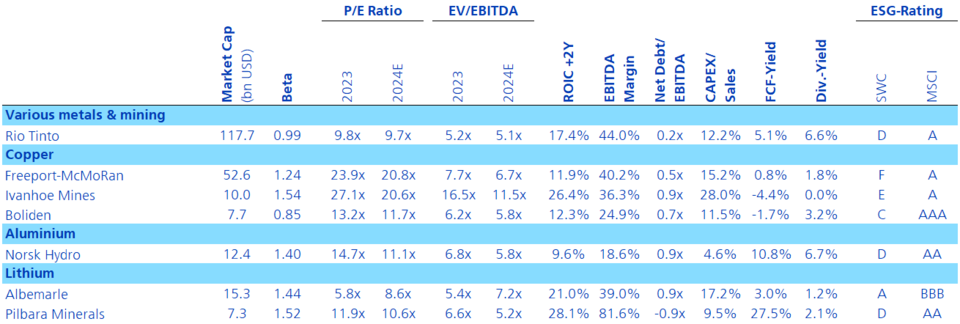

Fundamental research expertise is relevant for these dynamic topics and trends

In our active, fundamental equity strategies, we pay particular attention to developments in the commodities industry and consider critical raw materials to be essential for the energy transition. Nevertheless, it is important to note that commodity equities are subject to cyclical fluctuations, which in turn are influenced by various factors such as supply and demand, geopolitical events and macroeconomic trends. These cycles can present both opportunities and risks for investors alongside structural growth and are carefully monitored by us in order to make informed investment decisions. We currently recognise attractive sources of returns in commodities relevant to the energy transition, with quality characteristics (including stable earnings, strong balance sheets, high margins, low debt), attractive company valuations, strong returns on invested capital (ROIC) and a solid ESG risk profile at the heart of our stock selection. Accordingly, copper, aluminium and lithium are currently among our favourites.

Nevertheless, it is important to emphasise that many companies are excluded from our sustainable investment universe due to their controversial activities. At the same time, through our investment stewardship efforts, we do everything we can to scrutinise these companies.

Conclusion

The energy transition will only succeed in time if the supply of minerals can keep pace with demand. The most sustainable exploration of deposits, technical innovations and recycling are crucial to relieving the pressure on the raw materials markets. The strong dependence on individual countries such as China for the supply of these raw materials and for many supply chains for clean technologies poses a further risk to the transformation.

Excursus: Dependence on China threatens energy transition

The extraction of raw materials takes place in various countries. However, the processing of these main materials is still heavily dependent on a single country, namely China (see Figure 4). China recognised early on that decarbonisation and electrification are among the key megatrends of the 21st century. Consequently, China is pursuing an industrial policy with the aim of dominating the global market for electric vehicles, energy storage, renewable energies and their value chains, including critical minerals.

The IEA also warns that the geographical concentration in the processing of these metals will continue. This increases the risk of bottlenecks and unstable supply chains that could affect critical sectors of the energy transition. To mitigate this risk and secure the supply of critical metals, it is crucial to promote diversification throughout the supply chain through international co-operation.

Legal notices: This document is for information and advertising purposes. This document is intended for distribution in Switzerland and is not intended for investors in other countries. It does not constitute an offer or a recommendation to purchase, hold or sell financial instruments or to obtain services, nor does it form the basis for a contract or an obligation of any kind. The document was prepared by Zürcher Kantonalbank with customary due diligence and may contain information from carefully selected third-party sources. However, Zürcher Kantonalbank provides no warranty as to the correctness and completeness of the information contained therein and accepts no liability for damages resulting from the use of the document or information contained therein. Every investment involves risks, especially risks related to fluctuations in value, returns and, if applicable, currencies. Past performance and returns or estimates of future performance, returns and risks are not reliable indicators of future results. The information contained in this document may be modified by Zürcher Kantonalbank at any time without prior notice. This document was not prepared by the «financial analysis» department within the meaning of the «Directives on the Independence of Financial Research» published by the Swiss Bankers Association, hence these rules do not apply to this document. © 11.2023 Zürcher Kantonalbank. All rights reserved.