Solar module prices in free fall – what happens next?

Substantial overcapacity from China is causing prices of photovoltaic modules to plummet. Europe in particular is affected by the flood of supply from the Far East. The promotion of domestic production is now intended to prevent dependence on China. In the meantime, we have cut the weighting of investments in this area.

Authors: Nils Wimmersberger und Dr. Daniel Fauser

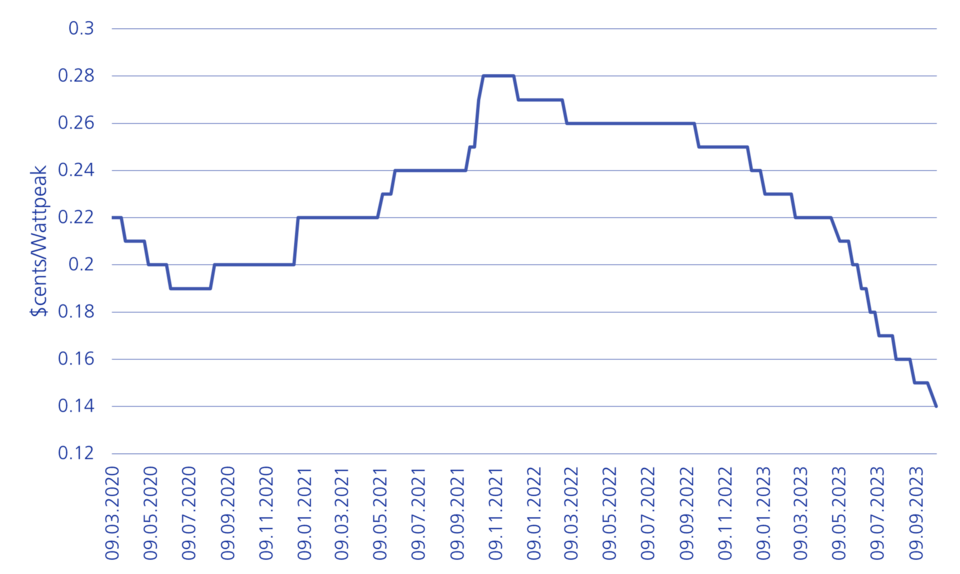

The photovoltaic (PV) market is in a perfect storm. A standard solar module cost as little as 14 US dollar cents per watt peak in September 2023. After prices rose sharply in 2021 due to raw material and supply bottlenecks, they initially stagnated last year. Prices have been in free fall since around the beginning of 2023 and are constantly reaching new record lows (see Chart 1) – and that for a form of power generation that has already been among the cheapest in the world for years. The reasons for this are complex and diverse.

With the start of the Russian invasion of Ukraine in February 2022 and the associated effects on global energy markets, the PV market experienced an unprecedented boom in demand in Europe. According to statements from industry insiders, enquiries for solar power system installations doubled within a week. While the lack of installation capacities was one of the most critical bottlenecks, China in particular responded with a massive and rapid expansion of production capacities. This lasted around six to nine months. As a result, there was a significant increase in the supply of solar modules at the beginning of 2023. At the same time, demand for PV modules in Europe fell compared to the extremely strong demand in 2022 – partly due to the somewhat normalising situation on the energy markets. Since the Chinese market – at least so far – has not been able to absorb the higher supply with higher demand, prices have come under pressure.

Price per watt peak for standard monocrystalline PV modules

China sets its sights on the European market

The US market is also currently unable to absorb the higher production volumes, especially since the Uyghur Forced Labor Prevention Act (UFLPA) came into force on 21 June 2022. The law prohibits the importation of goods manufactured in whole or in part in Xinjiang, China, or by an entity on the UFLPA restricted list. This has led to a partial relocation of Chinese solar module exports intended for the US market to Europe. The result is even greater oversupply and more pressure on prices. In addition, the USA also intends to boost domestic PV production capacities with the Inflation Reduction Act (IRA), which could also have a price-reducing effect at least in the medium term.

Several European and US market participants also accuse Chinese producers of engaging in cut-throat competition with unsustainable price dumping below manufacturing costs. Truly independent assessments of these allegations are hard to find. The fact is that declining margins along the solar value chain and write-downs on current inventories can already be seen today.

It is also a fact that the low prices of solar modules should bring the costs of the energy turnaround down significantly, which is in the interests of (European) policymakers. At the same time, European governments fear that there is too much dependence on China when it comes to PVs, similar to the dependence on Russia in the case of gas. That is why European countries are currently working on measures to reduce these dependencies and lead the European PV industry out from the shadows.

Solar industry at a crossroads in Europe

The modules from the old continent can often boast more advanced technologies and higher efficiency. However, with production costs of between 20 and 30 US dollar cents per watt peak, it is no longer economically sustainable. For instance, the Norwegian module manufacturer Norsun recently had to discontinue production until the end of the year, while the supplier Norwegian Crystals had to file for bankruptcy. According to the industry association SolarPower Europe, there are currently still 157 companies operating in various value-added processes in PV production. To ensure that this manufacturing know-how is retained in the future, various industry representatives, such as Meyer Burger, Heckert Solar, Wattkraft Systems and Interfloat Corporation, which all manufacture in Germany, have voiced their concerns loudly to the responsible politicians in Brussels and Berlin over the past few months.

An answer came quickly. The EU Commission, for example, has set a target to ensure that at least 40 percent of newly installed solar technology will be sourced from European manufacturers by 2030. The Net Zero Industry Act sets out the conditions under which the development of production capacities is to be supported with comprehensive financial measures in the member states. The subsidy drive is also slowly gaining momentum at the national level. In Germany, a market leader in the solar industry just ten years ago, Federal Minister for Economic Affairs Robert Habeck, for example, announced an expression of interest procedure for financing a flagship photovoltaic project.

Meyer Burger expands to Colorado

Solar module manufacturer Meyer Burger does not intend to wait any longer. The company has abandoned its expansion in Europe and will instead build up new production capacities in the USA. The City of Colorado Springs and the State of Colorado have committed to providing Meyer Burger with a financial package of USD 90 million from 2024. In addition, the Department of Energy and three major module purchasers will provide funding of USD 300 million. Finally, thanks to the IRA, tax credits totalling USD 1.4 billion could arise by 2032. That would be over USD 150 million per year over the next nine years and would reduce the cost per watt by 11 cents. Thanks to this support, the company plans to expand rapidly in the USA. The new solar cell plant in Colorado will produce solar cells with a capacity of two gigawatts to supply the solar module plant in Arizona. The latter will start production in the fourth quarter of 2024. However, there are certain risks associated with the transfer and start-up of the production facilities. For example, delivery times have been fixed by customers and delays would result in penalties.

It is, however, obvious who has won the first round in this race to promote the domestic solar industry. While measures to maintain the domestic PV industry are still being discussed in Europe, the USA is not only discussing the reduction of dependency on China, but is also actively and boldly pushing ahead.

Gradual reduction of PV investments

Since around the beginning of 2023, we have gradually decreased the overall weighting of PV in Zürcher Kantonalbank's active equity vehicles in asset management and completely eliminated it in individual strategies. The currently high overcapacity and falling margins as well as the political uncertainties and dependencies are giving us a rather cautious outlook at the moment. For us, however, PV remains one of the most important technologies for decarbonisation, which benefits from strong growth. The challenge for investors therefore remains: identifying PV companies that earn their cost of capital in the long term.