"Those who invest globally have significantly higher potential returns"

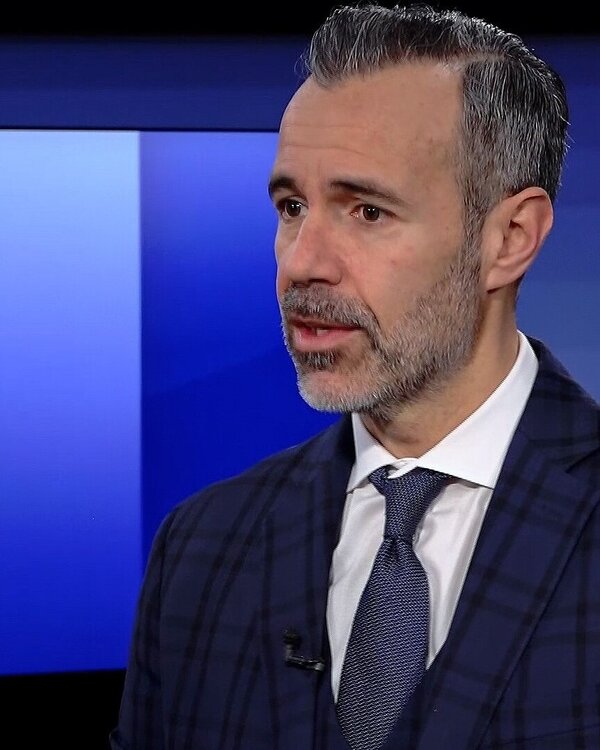

Although a diversified portfolio entails foreign currency risks, it also offers greater potential returns - a strategy that has paid off so far. In this interview, René Nicolodi, Head of Equities and Thematic Investment, explains the advantages of diversified investing and what to look out for.

Martin Spieler: What is the actual relationship between risk and diversification?

René Nicolodi: Basically, it's simple. Individual investments have a higher return potential compared to a well-diversified portfolio. In return, the risk of loss is higher. Two examples: If you had invested exclusively in Roche participation certificates a year ago, the investment would be worth around 15 per cent less today. If you had invested everything in Logitech a year ago, the gain would be over 50 per cent. By comparison, the diversified Swiss share index SPI has generated an average return of 6.5 per cent per year over the past 20 years - with significantly lower price fluctuations. Not putting all your eggs in the same basket therefore makes perfect sense from a risk-return perspective.

Diversification requires that asset classes do not develop in the same way. What does financial market research say in this regard?

The lower the correlation between two asset classes, the higher the diversification potential. This worked well between 2000 and 2020, for example, between bonds and equities. In 2022, however, this asset protection did not work because interest rates rose rapidly, putting equities and bonds under pressure. Correlations between two asset classes are not set in stone. Against this backdrop, active asset management is also important in order to be able to make adjustments to the investment portfolio virtually in real time.

What does an optimally diversified portfolio look like?

There is no such thing as optimal diversification per se. Rather, it must be tailored to the investor's risk appetite, risk capacity and investment horizon. It is important to adjust portfolios according to market changes. For example, if a portfolio consists of 60 per cent equities and 40 per cent bonds, the proportion of equities may become too high if equities perform better. As equities are usually riskier than bonds, the portfolio should be reorganised.

Some people shy away from international diversification because they fear currency losses – and rightly so?

Although the Swiss franc has steadily appreciated, taking foreign currency risks by investing in global equities has paid off in the past. As at the end of February, the MSCI World has outperformed the Swiss market by 55 per cent over the past ten years, calculated in Swiss francs. One reason for this is better sector diversification. The Swiss Performance Index has a defensive character and a high weighting in healthcare stocks, while there are practically no technology stocks. Those who invest globally have significantly higher potential returns.

Is diversification across various asset classes and key markets enough, or is more needed?

If you own bonds, property and equities and focus on the USA, Europe and Asia, you are already very well diversified. Professional investors diversify a little more, for example by focussing on thematic equities and tapping into other sources of returns such as emerging market bonds, commodities or private equity.

Private investors have limited funds. How can they still achieve meaningful diversification?

On the one hand, private investors can invest independently in selected actively or passively managed investment funds in the asset classes of equities, bonds, property and, if necessary, precious metals. On the other hand, so-called portfolio or strategy funds are also available. Here, investors can invest in a diversified manner according to their risk profile. The advantage of funds is that even small amounts can be managed professionally. As always, it is advisable to talk to your customer advisor before making a specific investment.

This interview was first broadcast in the "Geld" programme on 1 March 2023 on Tele 1, Tele M1 and TVO in Swiss-German.