The circular economy is becoming increasingly important

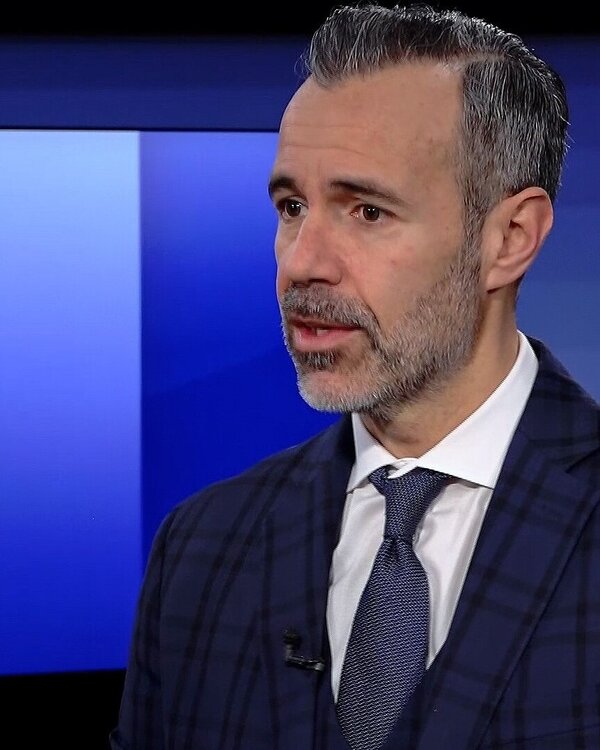

However, the topic is still not well known on the stock markets, says Iwan Deplazes in an interview. The Head Asset Management of Zürcher Kantonalbank explains the opportunities for investors.

Interview with Iwan Deplazes

Martin Spieler: Collecting glass and paper is something we take for granted today. But what does the circular economy mean for business processes?

Iwan Deplazes: The circular economy is becoming more and more important. This is what makes it so interesting as an investment theme. The potential is evident from the fact that today only 7% of the economy's consumption is based on recycled materials. More needs to be done.

The circular economy promises to reduce environmental damage. But is it also economically viable, or only thanks to taxpayers' money?

Government incentives are one of the factors that make it possible to operate circular economy processes economically. But society's consumer behaviour is also increasingly changing in this direction. This means that the circular economy is becoming an economic issue and more and more companies are getting involved.

Which companies in Switzerland are particularly in the spotlight when it comes to the circular economy?

For example, there is the ABB Group, which produces robots that can disassemble electronic waste. Sulzer, as another example, recycles plastics using chemical processes or develops biofuels.

What opportunities does the circular economy offer investors?

It is not yet a widely known investment theme. This is what can make it exciting from an investor's perspective: in more advanced themes, the market capitalisation of the companies involved is also significantly higher. We see great potential in companies that recycle vehicles, batteries or plastics. Our funds also invest in such stocks.

How can investments be made in as many circular economy companies as possible? Otherwise, there is a risk of backing individual business models that could also prove to be a flop.

That is indeed a crucial question. That's why it's so important to invest broadly. Certain companies operate in niches and may depend on how the state defines the regulation. The circular economy is a long-term investment theme – and one that can be covered with many companies.

What about the balance of opportunities and risks – especially for funds that focus on the circular economy?

The opportunities are certainly intact. This is especially true because the investment theme is at an early stage. Accordingly, companies in the circular economy can offer growth potential. But: this may also be accompanied by greater fluctuations.

Thematic fund on circular economy

Thematic fund on circular economy

This interview was first broadcast in Swiss German in a slightly modified form in the ‘Geld’ programme on 29 November 2024 on Tele 1, Tele M1 and TVO