Energy transition: Swiss equity market well positioned

Companies that position themselves early on environmental issues could be rewarded on the stock market, explains Iwan Deplazes in an interview. According to the head of asset management at Zürcher Kantonalbank, Swiss stocks may offer a good starting point.

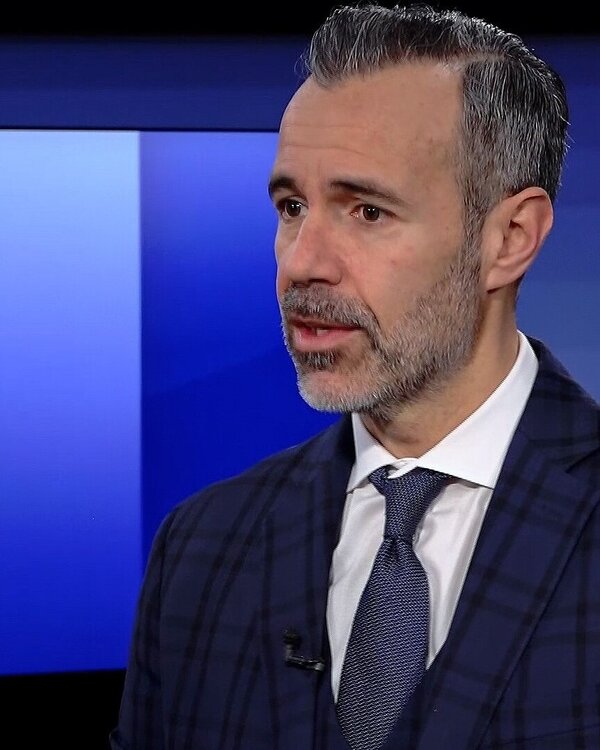

Interview with Iwan Deplazes

Martin Spieler: What is the role of financial companies in the energy transition?

Iwan Deplazes: The financial sector is not primarily responsible for CO2 emissions. On the other hand, it is our privilege and also our duty to allocate investment funds by investing in shares or bonds. And we can influence this by investing more in companies that are better than others in terms of CO2 emissions.

Sustainability aspects also play an important role for listed companies. Where do Swiss companies stand on the road to energy transition?

We are in a good position because of the industry mix on the Swiss stock market. Swiss companies are less active in CO2-intensive industries, with the exception of cement production. For example, the building materials company Holcim is the largest CO2 emitter in the Swiss Performance Index SPI, accounting for 80% of the total.

What indicators can investors use to see whether companies are making progress in the energy transition?

One measure that has become established is CO2 intensity. It shows CO2 emissions in relation to a company's sales. This allows investors to compare companies and their respective CO2 reduction paths.

What can investors do to help make the energy transition a success and what investment solutions are available?

Provided investors have the time and skills, they can analyse companies individually. But you have to go into detail and look at the current energy mix, for example. It is also important to consider how this mix has evolved over time. Alternatively, the analysis and selection can be left to specialists.

It should be noted that companies in the cleantech sector in particular have recently disappointed in terms of share price performance. What is the current outlook for the sector?

On the one hand, you have small and medium-sized companies that are innovative and developing CO2-reducing solutions, and on the other hand, you have large traditional companies that are trying to reduce their emissions over time. A good mix of the two stabilises returns.

How can sustainable investments be used to enhance a portfolio and hopefully also generate a good return?

At the Asset Management of Zürcher Kantonalbank, we believe that companies that position themselves early on to address environmental issues in the face of regulatory and social pressure may benefit in terms of their share price. Sustainability and performance are not mutually exclusive, but go hand in hand.

Equity funds in the context of the energy transition

Equity funds in the context of the energy transition

This interview was first broadcast in a slightly modified form in the programme ‘Geld’ on 18 October 2024 on Tele 1, Tele M1 and TVO (in Swiss German).