Stock market: Will 2025 be as strong as 2024?

The past year in equities brought investors strong returns. Will it continue at the same pace in 2025? René Nicolodi, Head of Equity & Themes in Asset Management at Zürcher Kantonalbank, urges caution. He identifies sectors that still have upside potential.

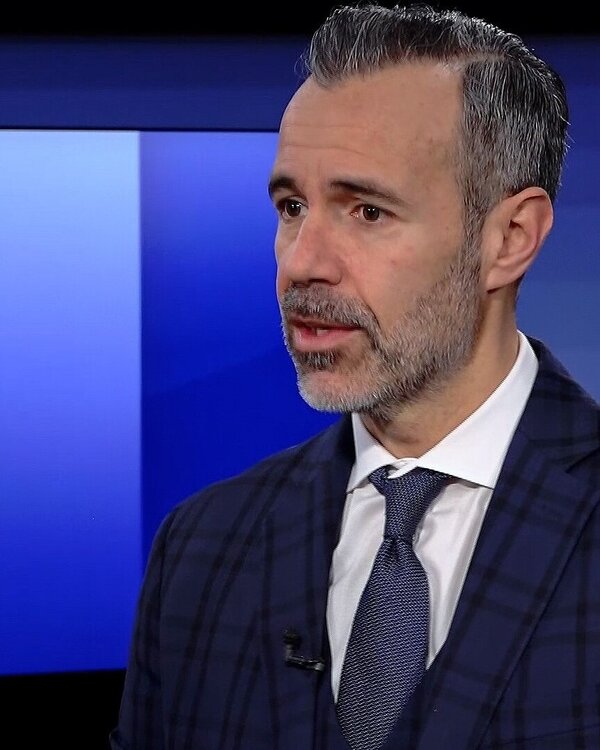

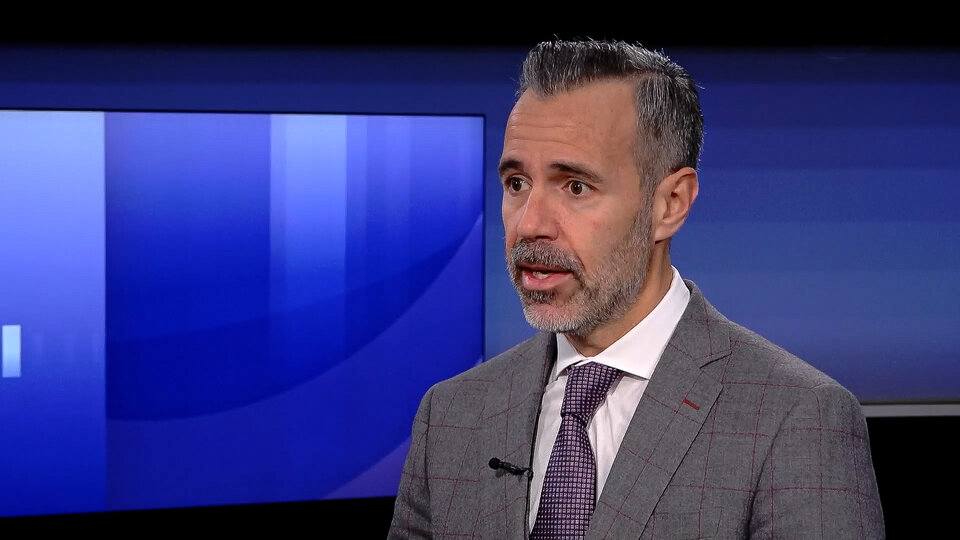

Interview with Dr René Nicolodi

Martin Spieler: What is your annual assessment for 2024?

René Nicolodi: 2024 was an exceptionally good year on the stock market. A mixed portfolio of a Swiss investor with an equity allocation of 50 per cent generated a return of around 12 per cent - that's above average. However, it is also true that only a few sources of return were strong. These primarily included significant share price gains by major US IT companies, which pushed the stock markets to record highs. Swiss and European shares were unable to keep pace.

Donald Trump's election was met with enthusiasm, particularly on the US markets. However, Trump is planning to introduce import tariffs from 2025. What impact could this have on the global economy?

It is relatively clear that there will be import duties. Who all will be affected is still unclear. The focus is currently on the USA's major trading partners, i.e. Mexico, Canada and China. In general, tariffs are a drag on growth and a drag on inflation and therefore a risk for equity markets. At the same time, tariffs are not the end of the world. China, for example, has diversified its export markets quite well in recent years.

Will the stock markets stay bullish?

The current environment continues to favour equities. We have a robust economy, falling interest rates and various countries are increasing their budget deficits, which is generally supportive of growth. However, we are now seeing very high valuations in some cases, particularly in the USA. This increases the risk of volatility and we will probably have to adjust to more moderate returns.

What will happen to interest rates and currencies in 2025?

Our economists assume that the central banks will continue to cut interest rates until the summer of 2025. For the US Federal Reserve, this means an interest rate in the region of 3.5 per cent and therefore outside of a restrictive environment. The Swiss National Bank is already talking about negative interest rates, so we expect two further rate cuts here. The Swiss franc remains structurally strong, while the USD is likely to weaken. We see opportunities in favourably valued currencies that could benefit from rising interest rates. This may apply to the Japanese yen, for example.

How should private investors position themselves for the coming year?

A diversified investment strategy across various sectors and countries is still recommended. Returns are not generated solely by US IT equities. In our opinion, gold also belongs in the portfolio. Due to the low level of interest rates in Switzerland, Swiss property and alternative investments, namely private equity, are also options to consider.

Where do you see the greatest opportunities and risks?

We see the biggest opportunities in sectors that have not been on investors' radar. These include the Japanese equity market and small and mid-capitalised US companies. Structural growth themes remain attractive - these include digitalisation and healthy longevity, for example. We see risks in corporate bonds, particularly in the USA. These are now very expensively valued and, in our view, do not adequately compensate for the risk.

Our Market Outlook 2025 and our in-depth analyses of equities and bonds provide further information on possible market developments.

This interview was first broadcast in a slightly modified form in the "Geld" programme on Tele 1, Tele M1 and TVO on 27 December 2024.