Investment returns

How are pension assets performing? Find out what returns have been achieved and what this means for pension funds and assets in the second pillar.

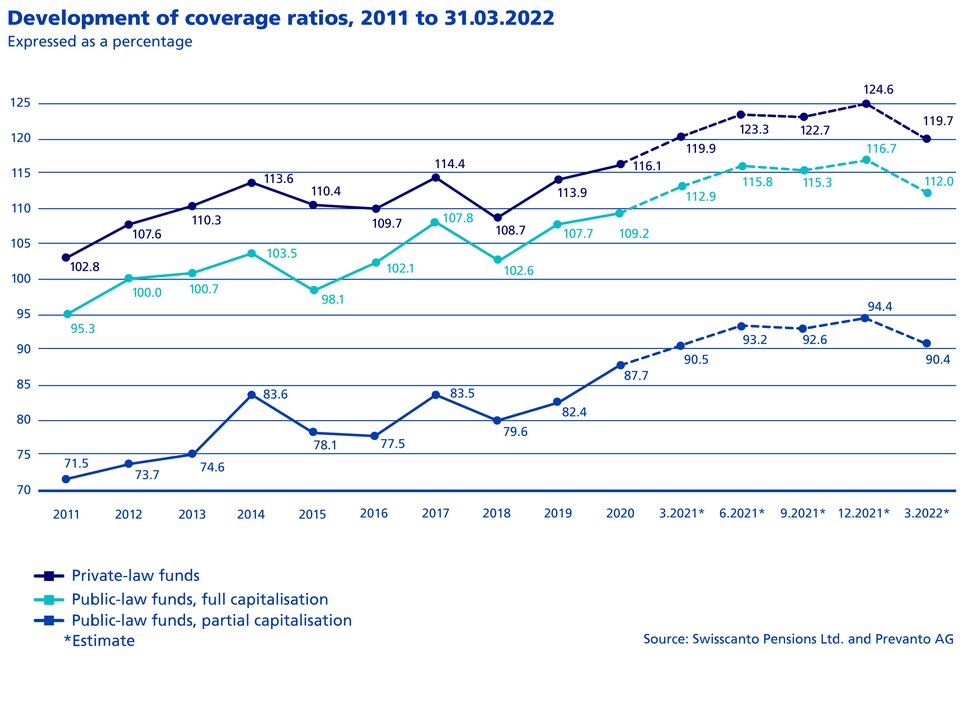

The Swisscanto Pension Funds Monitor provides you with quarterly information on the coverage ratio and investment performance of Swiss pension funds on average and in a quarterly comparison. This allows you to gain insights into the second pillar in general and derive valuable impetus for your investment decisions in particular.

The Swisscanto Pension Funds Monitor is published quarterly on the basis of our Pension Funds Study. It calculates the average coverage ratios of the current year and the average investment performance of Swiss pension funds during the year. In this way, the Pension Funds Monitor provides important key figures and valuable impetus for the decisions of those responsible for pension funds. The expected publication dates of the Pension Fund Monitor for 2022 are 26 July 2022, 26 October 2022 and 26 January 2023.

Our calculations are based on data from the Swisscanto Pension Funds Study, which is published annually. We estimate the coverage ratios of the current year for each pension fund and then aggregate all values. This results in the performance of the total assets. We generally use weighted averages to make estimates at an aggregated level.