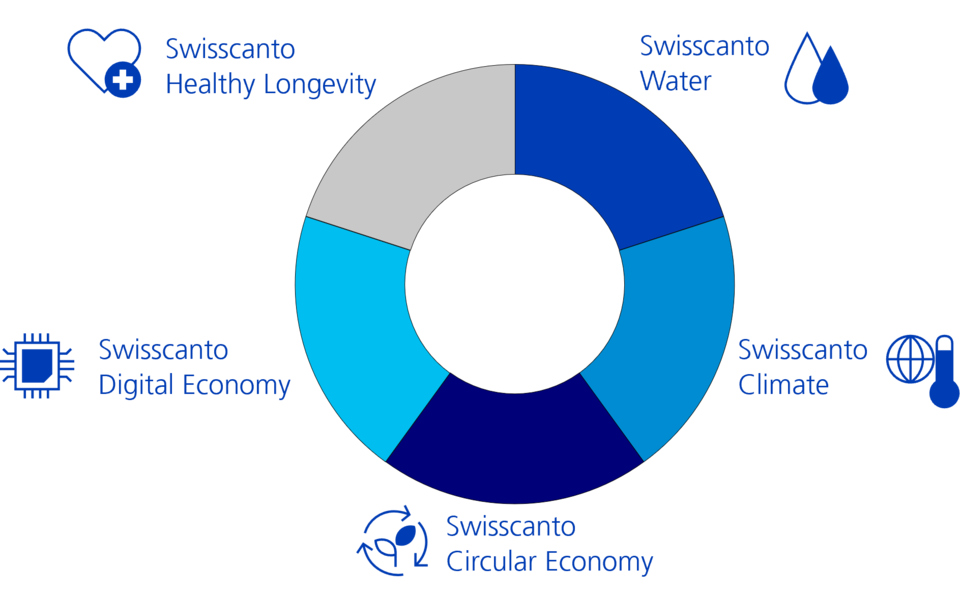

Attractive investment themes

Simultaneous access to investment themes of decarbonization, water scarcity solutions, circular economy, healthy longevity and digitization – with the potential for long-term growth.