«The Race Is Also On for Swiss Equities»

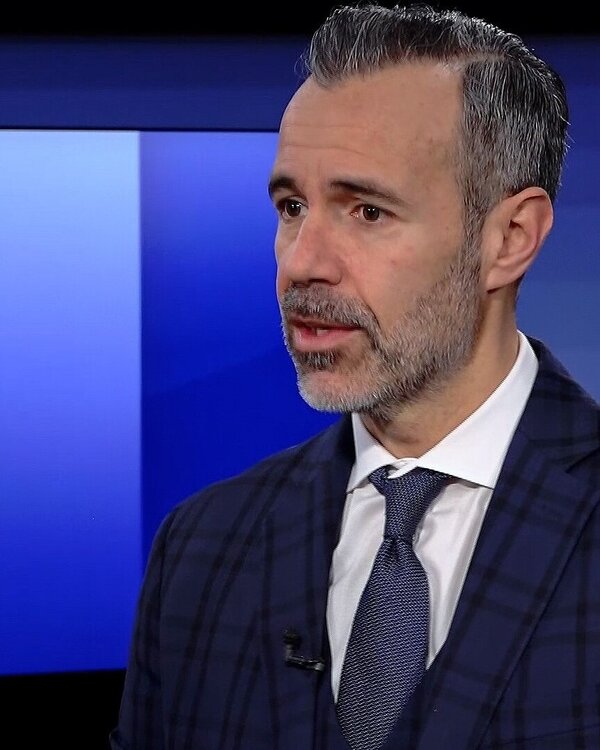

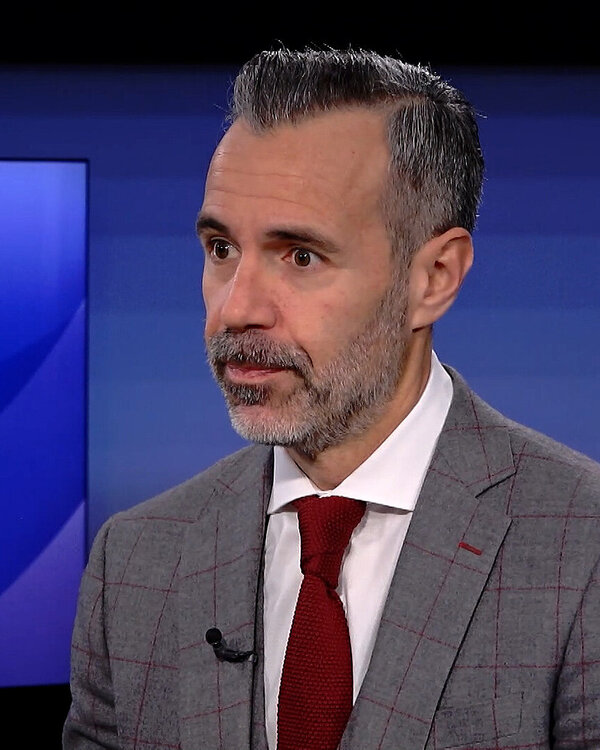

The second half of the stock market year 2024 has begun. In an interview with Martin Spieler, René Nicolodi reveals where he sees the best investment opportunities.

Interview with René Nicolodi

Martin Spieler: US stock markets have recently risen to record highs – what is your assessment of the first half of the year?

René Nicolodi: The first half of the year was very positive for investors. Driven by a wave of good corporate profits and a solid economy, the stock markets performed very well. The trend was also positive in terms of valuation. In 2023, IT and US stocks made strong gains, and this year European and Japanese equities have also risen. Swiss stocks are now also in the race.

However, we have experienced stronger price fluctuations time and again. Is there not also a risk of a bubble forming?

Valuations are indeed high in some places, even by historical standards. We are also sensing a certain euphoria. This must be a warning signal for investors, so short-term price corrections are to be expected. However, we would use such setbacks to make purchases, because: On average, companies are healthier, less indebted and have presented good earnings figures.

So the idea is not to take profits, but to be in the market for the long term?

We also remain optimistic for the second half of the year. The economy is likely to cool down. However, this will allow central banks more flexibility in cutting interest rates. This might prove to be fundamentally positive for both equities and bonds.

In fact, the prices of bonds, which are usually less susceptible to fluctuations, are likely to change in the second half of the year. This is probably due to falling interest rates. Do bonds look attractive to you in the second half of the year?

This is the main reason why we currently find government bonds particularly interesting. We expect that the economic slowdown will not yet be fully reflected in prices. The interest rate cuts could come sooner than the market expects. We therefore consider European government bonds in particular to be attractive. However, we are cautious about corporate bonds. The upside potential there seems limited to us.

What would be the weighting of different asset classes in the second half of the year?

We believe that a portfolio consisting of 50% equities, 40% bonds and 10% property can achieve a positive performance. On the equity side, the focus should be on stocks from Switzerland, the UK and emerging markets.

Apart from the national markets, where else do you see the best opportunities?

Emerging market bonds are certainly worth mentioning. Interest rates are particularly high in these markets and inflation is returning. Accordingly, interest rate cuts can be expected there. On the equity side, energy stocks look favourable if there is no recession. These stocks could also serve as a hedge if the situation in the Middle East escalates.

This interview was first broadcast in a slightly different form in the "Geld" programme on Tele 1, Tele M1 and TVO on July 5th 2024 (in Swiss German).